Q3 Interim Report 1 January – 30 September 2024

20 November 2024 | Company announcement No 26-2024

Risk Intelligence A/S (“Risk Intelligence” or "Company") hereby publishes the Q3 Interim Report for the period January - September 2024. The report is available on the Company's investor website (investor.riskintelligence.eu).

Highlights:

EBITDA Q3 positive by DKKt 65

CFFO improved by DKKm 6.2 compared to Q1-Q3 2023

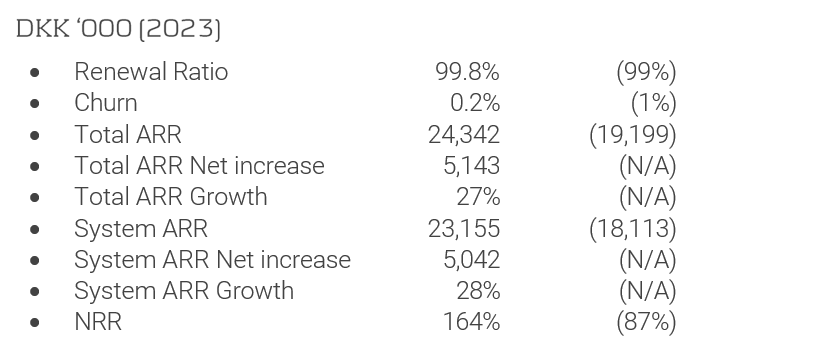

System recurring revenue (ARR) increased 28%

Churn 0.2%

Net Retention Rate (NRR) 164%

Guidance 2024 changed to a modest negative EBITDA

Total invoiced revenue increased 40% YTD and by 48% in Q3

Total revenue increased 29% YTD and 32% in Q3

Costs have increased 4% in Q3 and 5% YTD

Gross Margin (SaaS) 91.8% compared to Gross Margin (Reported) 65%

EBITDA 2024 increased 65% and 105% in Q3

Net profit in 2024 increased 34% and 48% in Q3

Cash Flow from ordinary activities DKKt -589 and Net Cash Flow DKKt 236 YTD

3 new maritime clients signed during Q3 2024

Risk Intelligence security data is now available for International SOS/Medaire luxury yacht members

Reporting period July 2024 – September 2024

Reporting period January 2024 – September 2024

Metrics FY 2024:

Guidance 2024 (Changed):

ARR Growth: 15 - 30%

System ARR: 22.4M – 25.3M DKK

EBITDA: Modest negative (previous around 0)

Net result: Negative

Net cash-flow: Positive

CEO Hans Tino Hansen

“It is my pleasure to announce that we for the first time during a third quarter have reached an important milestone with a small, but positive EBITDA of 65K DKK. This is the result of significant growth in recognised revenue of 32% and growth in cost by 4% during the third quarter, and subsequently 1.4M DKK higher EBITDA than Q3 2023.

During the first nine months of 2024 revenue has increased by 29% or 4.2M DKK compared to the same period in 2023, while the invoiced revenue has increased by 40% during the same period and 48% during the quarter. Costs have increased by 5% during the first nine months, which are predominantly the result of additional resources in the commercial department.

The impact on cash-flow from the growth in revenue is also significant with a positive change in CFFO of 2.3M DKK compared to Q3 2023 and 6.2M DKK compared to the first nine months of 2023. The net cash flow during the quarter was negative by 228K DKK due to changes in working capital. If we look at the liquidity generated from operations before interest the invoiced revenue constituted 6.8M DKK and costs 6.5M DKK resulting in a positive impact of 273K DKK.

The quarter saw three new maritime clients of which one a major energy company returning to Risk Intelligence. The growth in ARR has reached 28% for System ARR and 27% for total ARR, while the Net Retention Rate (NRR) reached 164% during the reporting period. Deducting one major new add-on agreement, the NRR for all other clients was 127%.

While we have experienced zero churn for several consecutive quarters, we had had one small license being terminated during Q3 resulting in 0.2% churn and this starts bringing churn back towards a more normal level of 2% on an annual basis as expected.

The need for our services is not decreasing as the geopolitical situation has not become more stable with the war in Ukraine, the war between Israel and Hamas, Hezbollah and Iran, the ongoing attacks by the Houthis in the Red Sea and Gulf of Aden, and the outlook from the upcoming Trump II administration.

The important positive EBITDA during the quarter signals that we have reached our first milestone on the path to profitability during 2025 while at the same time delivering growth in revenue.“

Presentations:

Live presentation 21 November 15.00 at Stokk.io, please subscribe on Stokk.io live presentation

For further information on services and the System:

Please watch our corporate video: Knowing Risk

For further information about Risk Intelligence, please contact:

Hans Tino Hansen, CEO

Jens Krøis, CFO

Telephone: +45 7026 6230

E-mail: investor@riskintelligence.eu

Website and social media:

Website: investor.riskintelligence.eu

Twitter: twitter.com/riskstaff

LinkedIn: linkedin.com/company/risk-intelligence

Facebook: facebook.com/riskstaff